TEEF FROM TEEF GOD BUS A BIG LAUGH OOO…DI PEOPLE DEM BUY DI HOUSE FI 410K DI JANUARY, FIX IT UP AND SELL IT TO TAMARA FI 850K..DI PEOPLE DEM SEH DI HOUSE HAVE TWO MORTGAGE ONE FI 637K AND A NEXT ONE DI 212.5K..ONE MORTGAGE FI $4000 AND DI NEXT ONE FI $1045..SUH FROM APRIL DI PEOPLE DEM A GIVE HAR A RUN AND NAH PAY WHAT DEM OWE SO SHE CAN PAY HAR MORTGAGE OO

My gad! All di business a buss out now..ole people sey di higher di monkey climb di more him baxide expose.

so a wonder if a she did come and talk bout the inventory pon the bag, because she nevah get the money fe pay the mortgage.

To me all har customers and workers don’t seem worried at all..

a fool and his teef’n money shall………….:nerd

luv run in pon things nd doah knw shit,den God nuh mus laff dem double up pon buy she buy de wan house twice

Real Estate the biggest hustle, creeme!

Double Mortgaged tho?? :matabelo

Iy your mortgage is below 80%ltv you do not have to pay pmi so to get around that people take out 2 different loans.

This is why I’m such a big proponent of education. With all the street smarts to commit crime she went an bought an overvalued home. Unless this house was bought in 2005 at the peak of the housing bubble, then she has to be the biggest idiot on the planet.

Do you know how stressful it is to be paying $5000 per month for mortgage payment alone and that doesn’t include other living expenses? That simply means she would have to be stealing for the next 30 years or have a substantive client base to pay off the mortgage. Either way, trouble was just around the corner.

Straight robbery. In a 06 every and anybody could s buy house all without social. There wasn’t any income check or no form a verification. U want it u got it. Anything buy ina 05-08 was robbery. Di price dem di double thathat’s why so much mortgage brokers attorney out a business now

Even though that was the practice back then, what was happening was straight Mortgage fraud and if the Feds want to go after her now, they can pursue her for Mortgage Fraud just to heap it on. She definitely signed some document stating her income was XYZ during the Mortgage application process. Now we are hearing she probably has another house in LI which will probably go into foreclosure now like the one in Queens.

Yes quena. She couldn’t get the whole 850000 one place cause di house no worth it, she didnt put down no money so she had to get the difference somewhere else

:matabelo One word describes this: DESPERATION!!!

Somebody please accept Tam Tam’s colleck call and tell her she should have linked Quena!

What was the purpose of buying under her name if all this? Why not have a partner?

800-you-wudda-have-lawyer-loot-now

800-to-late-to-call-QUENA

Quena, stay clear of this one…she got herself into this mess…let her get herself out of it…

Your right mi Amiga…..my comments regarding her house are all in jest.

When Feds finish scrutinizing this one!!

Like these muthaf***kas make good decent Caribbeans look like shit and then have the audacity to high step it as if them is any beta than the next woman weh buss her ass working a legit 9 to 5 while trying to make ends meet and raise her family the best way she knows how… ah have ah good mind fe help out the DA wid what me know..SICK AND TIRED OF ALL OF THEM AND MI NOT JOKING NEEDA!! 😡

How this bitch didn’t see this shit coming…and of all things, kept going…

Di smaller loan usually carry ah very low interest rate, and sensible people usually pay off that one way in advance. Dem mascot deh cah only read pitcho of designer clothes, bags, and shoes. When it come tuh other tings dem clueless is ah shame……

Mama u gonna need Jesus all boils down to greed

Yuh see how dem brite an dem chest higher dan who legitimately ah mek 6-figures??? Mi nuh sorry fi har and mi knoe seh all who trust di teefin goods ah pray hard cah dem nuh waan pay :ngakak.

Di Feds nuh done wid ar yet…more charges to come cause dem not even touch pan di money laundering and mortgage fraud YET!!!

Yawdy, coo much sexy dainty good name brand quality shoes and bag sell ah Marshalls, T.J.Maxx, Nordstrom Rack, dem place deh…and that wasn’t good enough for her…can you imagine the nightmare these people had to go thru seeing these outrageous/fraudulent charges on their credit card and bank card statements…this cannot even begin to compare to how we get vex when grocery store overcharge us and our receipts don’t reflect the sale prices as advertised…Yea, make a nasty example out of them all because of the mental trauma and distress they’ve caused everyone involved…hope a a loving n’ caring relative can take care of their kids *if they have any*..if any bloggers were affected by these bitches, blow up the DA’s phone and chat like parakeet….talk EVERYTING!!!

Same suh Yeppy :2thumbup

@2013 her customers n workers don’t seem worried bcuz there’s no loyalties among thieves dem not loosing no sleep a nite time dem outsmart DA feds n fly rite under da feds radar dem get weh like smooth criminals

Stupiddddddddd girllll. All dem ting she tiefing. Shi couldn’t tief a Chanel bag GI a good real estate lawyer fi some help if she had no idea about real estate.

But yet shi tief and sell to people who cyaan read and write…

Y would she take a mortgage for that amount n know she not making that kinda money n my número uno question is y was she hoarding these stuff when clearly she had a money gap y not unload dem quickly smh a mus joke this to rawsee

Cheutty mummy, ah suh weh dem hab years ah service inna teef dem get delusional an feel seh is ah guaranteed paycheck de ah earn. Das why mi convinced seh teefin is ah mental disorder, dis gyal str888t mad….

Yawdy mi honey a really clean clothes mad ppl dem be how the hell mi fi go pick up mortgage of that amount n nahhhhhhh wuk dem breed a money deh??? No sahhhh

Her biggest bet right now is to sell. Theres lots of investors who will give her 100,000, she sign over her deed and them work something out with the original pple weh lend her the money. They have no choice but to negotiate and tek something. No bank want to foreclose so they will settle. And everybody win. She get 100k, the bank get something and the investor sell back the house or rent it.

She can’t possibly get 100,000 or anything for this house when there is no equity in the house and she’s upside down. Investors don’t go after bad deals, they go for steals. Her only choice is to do a short sale. If the bank accepts a short sale, then she can sell the house for what it’s worth and the bank absorbs the loss (which isn’t really a loss to the bank since the house was never legitimately worth that). The new owners will purchase the house at fair market value and she will walk away without having a foreclosure on her credit. But there isn’t an investor in the book that would touch this and give her money when there is no equity in the property.

Failing that, when the bank forecloses and the title reverts to the bank, the house is placed up for auction and the investors with their cash money makes a low bid for $100,000-$150,000, depending on the state of the property. The bank sells it to them free and clear and the investor re-sells at market price and makes a killing. That’s how it works.

Yes foxy there is. They have investors who live for these things, because they work with the banks yo settle for little or nothing. To them they’re paying 100,000 for a 465000 house. They settle with the bank fi bout 200,000 even 300,000. They’re still winning.

No Fabby…if they settle with the bank for 2 or 3, then pay her 1, then sell it back for market value, there is nothing to be made. She has no equity so they would only offer her out without giving her anything. She can’t and won’t get any money from anywhere. This is not the part where investors enter. If you’ve ever been to a real estate auction, you’ll see how the investors operate.

They purchase foreclosed properties for cash at the auction for pretty cheap. I encourage you to visit one. Trust me on this, I have first hand knowledge on the entire gamut of this business.

Dont sell, rent. I have some im doing now. Same scenario. Minus di tiefing. This one lady now in jamaica queens, husband was a dealer. And bought around 2006 as well. O house in the lady name. Husband lef her. Now she in the same position. They gave her 80,000. Settle with round point mortgage for 75,000.00. She sign over her deed. She’s still living there cause him rent it back to her then rent out the other floor. These Jews know what to do.

Both of you are correct, the bank is not looking to gain, they just want there money. The Investor standS to gain by renting,especially if said investor is a multiple home owner. In New York though not many single home investors are looking to take on the headache of being a Landlord.

The thief doesn’t have equity in the home but as long as the new investor get the home for less than the appraised value they will have equity. My question is what bank in their right mind gave her a loan of $850k for a property that only woarth $465k. The bank loss big time. I wish I was the person who sold her that house.

Me say met ,if u yard noice one more time u see :ngakak :malu :ngakak

But the lawyer she usw buy is warren and Warren on hillside and they are usually good. But them time deh everybody s work together. She look the house, the broker tell her him know a mortgage guy the mortgage guy tell her bout an attorney, the attorney order fr a title company him a get kick back fr. They all work together and split the back end money. Big business them time deh

Also from the looks of the pic this housd looks like a decorated matches box is how much room it have Met $850,000.00 no fi look so

Couple months ago we viewed a house in Freeport LI for $700,000.00 huge house circular driveway pool in the back is which pawt this house deh n y so much money????

I think she was renting out one of the units for about $1,950 per month. I’m assuming she was living in the other unit. From what I understand, the house was originally a single family house and the previous owner (Investor/Contractor) converted it to a two-family property. Don’t know the zoning laws in New York, but in other States, this type of conversion would be illegal per the Zoning laws. Not clear if the conversion was done legally and approved by the building department in NYC.

Judging from all the stolen goods in her house, she might not have been doing that great moving the goods or asking price was tool high, hence problems paying the mortgage on the over price property.

5grand fi mortgage?! I don’t even pay a 3rd of that and every month when I get di bill I feel like I want to stab myself in the eye with a fork.

Seet deh as di word mortgage mention mi see a link pon di battam a di page weh seh: searching for mortgage? She coulda probably click that random link and get a better deal dan wah she en up wid.

:ngakak

@anon 11:02 it was converted legally. Its s legal 2 family.

From I was BORN, LOL. I cannot laugh no more, This happen to a lot of people who wanted a house and never have the right document to get the house, LOL. I can’t. Me beleee, Street smart to theef and sell theefing goods but Illiterate to know that the deal she get was ridicoulous, Those mortgage broker who did her loan Laugh all the way to the bank. LOL. Dancehall people all a unuh dunce no rass.

Metty, did she have any *real* Hollywood clients?…that’s what i’d like to know cause dem breed ah connery ya have to span past dancehall…

Pls someone tell mi where is this house & wht yr she got it

Bellerose Queens, NY

2009

I wonder if they paid someone to under appraise the home so that they can pay less property tax.

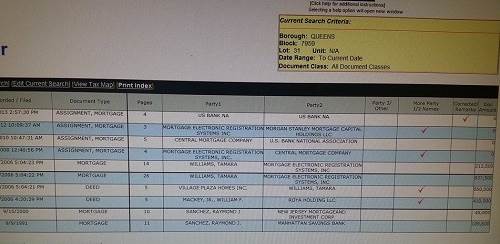

Belrose. 2006. Not under appraise. The broker over appraise. With a drive by appraisal. Use the outside pic of her house abd the inside pics of a property weh di inside tunn up. Her property tax is $1914.30. Ans she owe 1042.27 in water.

But wid di amount a stock she have she cudda mek a sale it look like she did a hold out pan price pan di people dem goods mon :nohope:

Met dem can act like a pay them pay fi pple things. One come in a di beauty parlor weh day me a do me hair. She a sell gap shirts. Di price pon si shirts was 49.99 and she want 30.00 a guy a gi her 20 and she naa tek it. Me under di dryer a smh

$1914.30 is low for for a property that was wrongly appraised for $850k. Is that the annual amount or every 6 months?

No sah! unno bad in yah like ebola!!! unno a di best to baxide.

NO TELLIN SHE ALL PUT DEM PON AUCTION SITE LIKE EBAY…THATS A FORUM FOR ILLEGAL ACTIVITY–SELLERS WITH STOLEN PROPERTY/SCAMS. EBAY ALWAYS WARN BUYERS TO BE CAREFUL OF YOUR PURCHASE AND SOME MAY NOT BE LIGIT.

Ebay themselves is full SHIT like land crab…

Predatory lending at it finest. Tammy as a fellow was just looking to buy and they were looking to sell. Shoe couldn’t get government backed loans due to the conviction. What’s interseting is that she managed to keep up with the payments when she was away for her prior conviction. Because of said conviction she can not even get the government backed refi through HArp or any other program. The Loan was insured so the bank and the investors will not loose. Tammy is a survivor. Her goods were certainly not all confiscated but she also was owed money by many.

Original SMH…yuh tink dem deh client deh ah pay har weh dem owe? Dem gooda all glad she gone so dem noh haffi pay

from what I read this girl fool to rass a wonder who she calling and who visiting her and what brand name she a way a in the jail now

Prison Blues…

$5K per month in mortgage :cd :hoax2

Tamarraaaaaa but a whey di bumboblootclaat dis and yuh stop pay the people dem mortgage. Suh Tamaraaa yuh is one dem whey live inna the people dem house and not paying to live in it. Mi sey again Tamaraaa dats why mi nuh grudge nuh badayyy fi whey dem have. Unuh floss and cannot maintain unuh flossments. Tamaraaa how yuh feel fi wake up inna the people dem good house and not paying to live inna it and yuh guh outta road guh floss. Tamaraa yuh shudda have a legit job as backup so when yuh custie dem nuh pay yuh on time, the legit job can back up the mortgage money. Tamaraa yuh corna more dan dark now, causen sey dem gwine tek whey even the hair offa yuh puxxy.

Solid advise about the legit back up job to pay your mortgage but Tamarraaaaaaa was doomed from start!

$5000. mortgage DAYUUUUUUUUUUM!

Did she not work at Saks Fifth Avenue? That was the backup job.

SHE DID NOT WORK AT SAKS

Nobody can carry such a high mortgage unless dem a meck some serious money. Even Suze Orman nah advise dem high mortgage yah. In truth, rent or mortgage should only teck 30% of your net monthly income. Wid 5k fi mortgage alone you still a look pon insurance, gas, heat, wata, food and all di oddas, all a dat pon sales rep salary. Even if shi a teck een 70k/yr wid commissions dat is too high. Betta shi did buy a cheap house a Georgia and rent it out, and stay renting a NYC.

First of all how did she qualify for a 800k mortgage working at saks? Met you cant get the address fi mi .A dem ting deh mi buy from bank. You can get a nice little ting fi yuself if mi buy it.

Damn